Illustrative image | source: CoinBank https://coinbank.cz/portal-o-kryptomenach

Shortly after midnight on Saturday, the fourth halving of the remuneration for the miners for their work took place. They now only receive 3.125 bitcoins for verifying each block. Each such event raises questions about whether the halving will go smoothly, what impact it will have on the mining community, how the lower supply will affect investor interest, and last but not least, how the halving will affect the broader market context.

Halving

Bitcoin maintains deflationary potential with its setup. The regular reduction of the new issue of Bitcoins until all Bitcoins are mined essentially make this digital asset a rare commodity. Each halving of the reward thus represents a challenge for the market, whether the pre-set algorithms will work as they should and, above all, as the market expects. Today we can say that halving the reward, which took place in the early hours of April 20, 2024, followed up on its three previous halvings and went smoothly. The new reward amount for miners for their work is 3.125 BTC.

Impact on miners

Undoubtedly, the sudden decrease in reward has an impact on the activity of miners. For some of them, block authentication will happen unprofitable matter, which may ultimately lead to the termination of their activity. The logic is quite simple, while before the halving miners competed for a reward of 6.25 BTC (approx. 1x per ten minutes), after the halving the same number of miners compete for only 3.125 BTC.

Imagine that you are part of a team that receives a predetermined reward for the work done. However, it is not paid proportionally, but according to how one worked. In order to get paid enough to cover your living expenses and save a little extra, you’ll need to do more work than other team members. But you can only achieve this by increasing your commitment and work performance. But what happens when the reward paid is halved from day to day?

In the best case, the reward will at least cover living expenses, but in the worst case, it may not be enough. In addition, if you can no longer increase your work pace, or you don’t have any financial reserves from which you could cover your expenses, such work will be unprofitable for you. You can try to hang on if the situation doesn’t improve anytime soon, but it’s much more likely that you’ll end up with a job like this, and you probably won’t be the only one.

Total Miners’ Earnings (edited by author) |source: Glassnode

https://studio.glassnode.com/metrics?a=BTC&m=mining.RevenueSum&pScl=log

Miners will also behave in exactly the same way. Some may just shut down their mining hardware temporarily, others will sell it outright and ceases its activity. This will reduce the pressure for higher performance and at the same time reduce the membership base, among which the reduced remuneration is shared. By spreading the reward among a smaller membership base, individual members get a larger share of the reward and can restore their profitability. After all, miners follow the price of Bitcoin, not the other way around. One can thus speak of a certain form of game theory.

It is precisely the highly competitive environment that forces miners to constantly invest part of their profits in innovation. They gain a competitive advantage only by achieving greater computing power with lower energy consumption. New generation mining hardware can currently increase computing power up to 3.4 exahashes per second while maintaining energy efficiency. In this way, miners are able to increase their profitability, especially in the challenging first days after the reward is halved. This upgrade not only helps keep the entire blockchain running, but also contributes to the overall efficiency of the mining process.

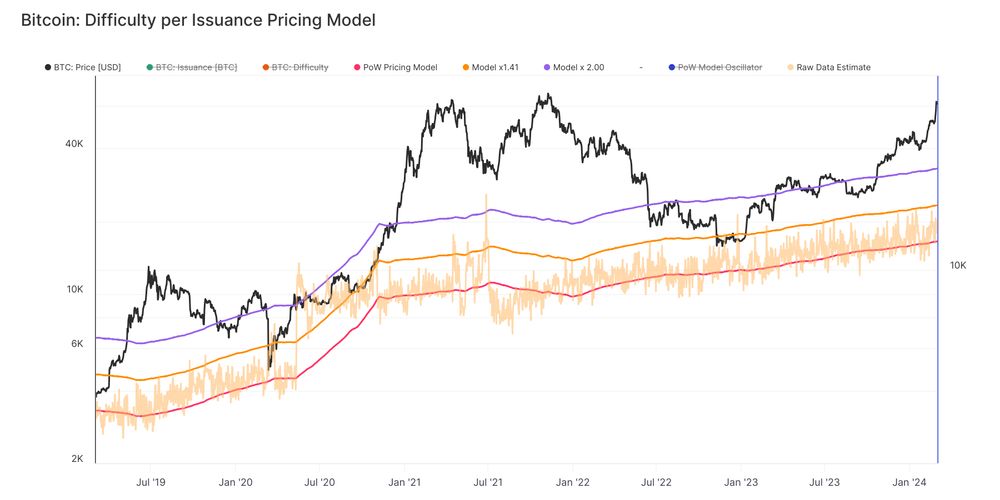

Ratio of mining difficulty to reward emission (edited by the author) | source: Glassnode https://insights.glassnode.com/bitcoin-halving-directional-traders-guide/

Demand for BTC

Bitcoin is often compared to gold. On the one hand, this is because, like gold, there is a limited amount of it, and on the other hand, like gold, it has less utility in the world of traditional finance. In this direction, Bitcoin was significantly helped by the January approval exchange-traded funds(ETF) with Bitcoins. It is the ETF products with bitcoins that are currently playing a major role in the transformation of the cryptocurrency market. They make it possible to mix Bitcoin with traditional financial markets.

The Bitcoin ETF comes at a time when the world economy has emerged from the crisis caused by the covid pandemic and Russia’s invasion of Ukraine. Thanks to this, investors are looking for ways to diversify their portfolios and are again considering risky assets. Risky assets also include cryptocurrencies, i.e. Bitcoin. ETFs give traditional investors a way to invest in Bitcoin in a way that is known and most importantly regulated. Such an environment attracts large institutional players who approach their investment ventures with long-term strategies and robust risk management.

Through the ETF, the existence of Bitcoin as such is legitimized, which will positively contribute to stabilizing the price and reducing the overall volatility of the market in the future. In addition, these investment products demonstrate the permanent presence of Bitcoin within the financial markets and are a signal to all those who doubted Bitcoin until now that this digital asset is here to stay and is not about to fall, as some are still predicting.

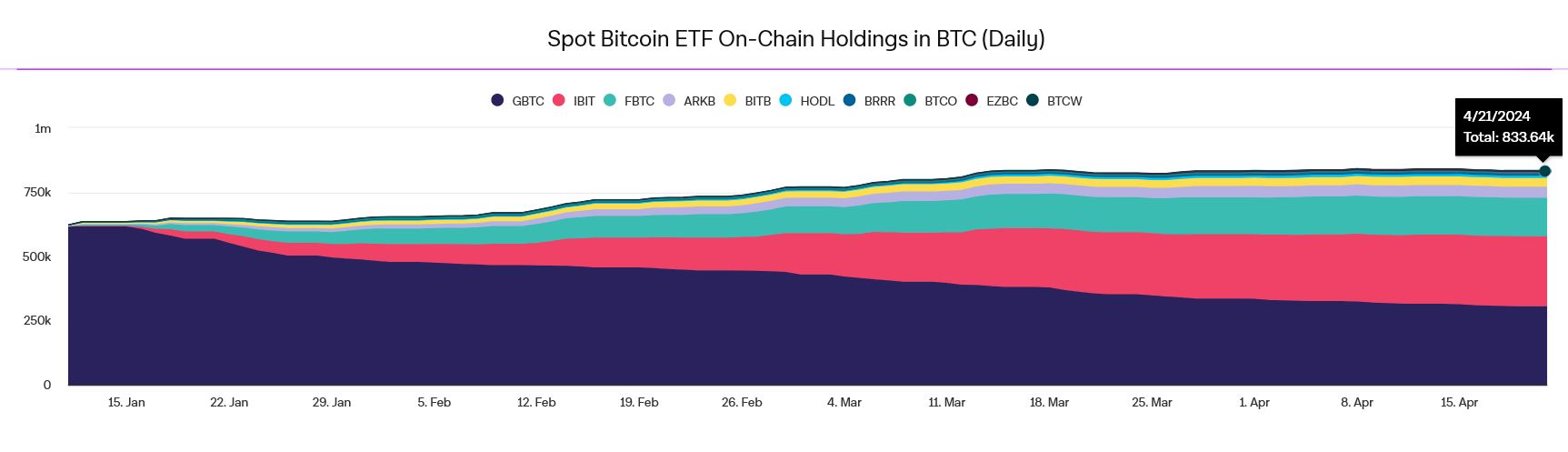

Through Bitcoin ETFs, the floodgates have opened institutional demands, which was not slowed down even by Saturday’s halving. There are currently more than 833,640 bitcoins allocated in the ETF, worth over $55.02 billion. To give you an idea, this is more than 1.281 trillion crowns (approx. 60% of the entire Czech budget). Moreover, thanks to the inflow of institutional capital, the liquidity of the entire market increases significantly. It is almost certain that Bitcoin will continue to play a role in shaping the future shape of financial systems.

Total Equity in ETFs (edited by author) | source: The Block https://www.theblock.co/data/crypto-markets/bitcoin-etf/spot-bitcoin-etf-onchain-holdings

Impact on the market

As stated above, miners follow the price of Bitcoin. That is, when the value of Bitcoin decreases, some miners have no problem shutting down their mining hardware for a while and not wasting costs unnecessarily on loss-making activities. Conversely, if the price of Bitcoin rises high enough, that it is worthwhile for new miners to enter the market, so they will do so. Although the immediate increase in price after a halving is not always obvious, there is general agreement that the halving will have a positive impact on the value of Bitcoin in the long term, just as it has in the past.

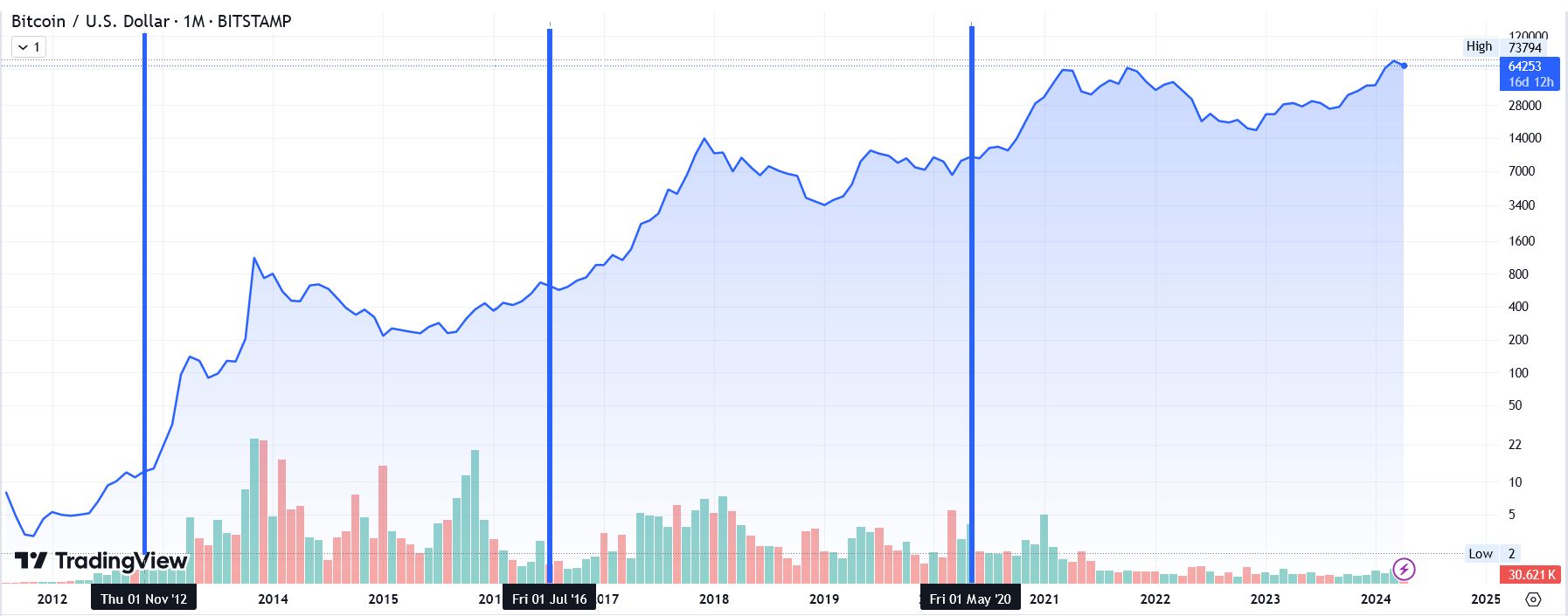

BTC entered the first halving (November 2012) with a value of $12. It started to grow in the following months and by the end of 2013 it was already selling for more than $1,200 ($1,242). This represents an increase of 9937%. We witnessed a similar development after the second halving in July 2016. Bitcoin entered its third 4-year period with a value of around $650 ($664). It did not last long at this value, when it started to grow again in the following months. In November 2017, it was then sold for almost $20,000 ($19,804). Bitcoin to strengthen by 2903% within this session.

At the same time, it is true that after reaching the maximum, bitcoin corrected its value. It also happened within the third 4-year cycle, when it entered the third halving in May 2020 with a value of around $8,500 ($8,571) to reach its then all-time high of around $69,000 ($68,997) in November 2021. This rally represents an increase of 705%. All three halvings so far have one thing in common, they always happened 12 to 18 months after the halving to a sharp increase in price. A high enough price will immediately attract new miners who will increase competition, which ultimately leads to a price correction.

Bitcoin value chart with halving dates marked (edited by author) | source: TradingView https://www.tradingview.com/chart/?symbol=BITSTAMP%3ABTCUSD

View

It can be assumed that even this cycle will not be different from the previous ones. Innovation will continue in the form of the introduction of more energy-efficient hardware technologies, and ever-increasing computing power will compete for the reward for verifying new blocks. Such competition is essential to the long-term stability of the entire Bitcoin blockchain and strengthens the position of this unique system for the future.

With each halving, Bitcoin approaches its final supply limit. After all, this is also reflected in the decreasing rate of appreciation of this oldest cryptocurrency. With each subsequent halving, the impact of this event on the market will decrease. The more the importance of the halving declines, the more Bitcoin’s uniqueness and demand should play a role. Bitcoin has the potential to continue to influence global financial markets. However, it will depend on the community as a whole how significant a role it will play in the future.

The information contained in this article does not serve as investment advice. They are for informational purposes only.

Ing. Zbyněk Kalousek

He studied economics and management at the Masaryk University in Brno. In the past, he was engaged in the analysis of financial markets. He returns to this activity after a short pause. Co-founder of a company that deals with consulting and accredited education. He cooperates with several other companies. He perceives the world of cryptocurrencies as a progressive part of the market, which offers a lot of opportunities, but at the same time presents a lot of pitfalls, from decentralization, an apolitical approach, to high volatility of exchange rates, to the increasingly difficult mining of cryptocurrencies.

CoinBank

Since 2021, it has been working with MipSoftware, which operates the CoinBank cryptocurrency exchange and the CoinBank Trader cryptocurrency exchange. Both platforms are particularly interesting for Central European clientele. Through its product, it connects end users with the world’s largest crypto exchanges and offers a pleasant user experience. For a Czech client, trading using Czech currency is probably the most pleasant function. A wide range of cryptocurrencies, access to the world’s largest exchanges, these are prerequisites for interesting cooperation.

More information at https://coinbank.cz/.

Tags: Bitcoin Halving Successful Whats

-