25/04/2024 08:49, BAAGECBA

Moneta Money Bank presented 1Q results, conference call at 10:00 AM. Net income beat expectations as a year-over-year increase in adjustments was offset by an increase in operating income. The management confirmed the intention to deliver a net profit of at least CZK 5.2 billion this year.

| Management of Moneta Money Bank for 1Q 2024 | ||||

|---|---|---|---|---|

| in million CZK | 1Q 2024 | Market consensus | 1Q 2023 | |

| Net interest income | 2,075 | 2,092 | 2,031 | |

| Net of fees and commissions | 740 | 680 | 616 | |

| Other operating income | 302 | 232 | 197 | |

| Operating income | 3 117 | 3004 | 2,844 | |

| Operating costs | (1,486) | (1,515) | (1,545) | |

| Operating profit | 1,631 | 1,489 | 1,299 | |

| Cost of risk | (135) | (124) | 116 | |

| The net profit | 1,286 | 1 171 | 1,215 | |

Net interest income in 1Q they were CZK 2,075 million, 2% higher year-on-year, 1% below consensus. The net interest margin decreased year-on-year by 0.3 percentage points to 1.8%.

Net of fees and commissions in 1Q they grew by 20% year-on-year. Growth was driven by sales of insurance and investment funds.

Other operating income also increased significantly year-on-year, when their growth was supported by the positive impact from foreign currency transactions and the extraordinary income from the sale of a small part of the investment portfolio.

Operating costs decreased by 4% year-on-year thanks to a lower contribution to regulatory funds and lower administrative costs.

Moneta Money Bank operating cost structure

At the operational level, the bank reported a profit of CZK 1,631 million, a year-on-year increase of 26% and 10% above the consensus. Our projection assumed an operating profit of CZK 1,525 million.

Cost of risk in the amount of CZK 135 million. were 9% above market expectations, but in line with management’s outlook for the year (20 basis points).

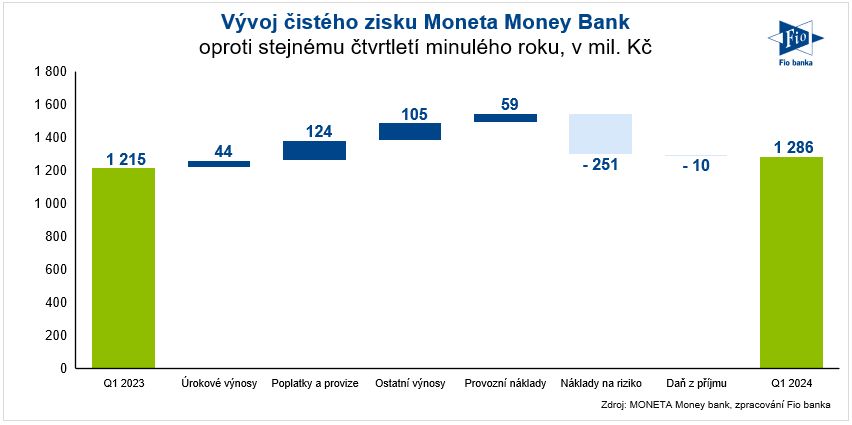

Overall, yes the net profit of the bank in the amount of CZK 1,286 million was 6% higher year-on-year and 10% higher than the market estimate. Our estimate was in the amount of CZK 1,191 million, so Moneta exceeded it by 8%.

Development of Moneta Money Bank’s net profit, source: Moneta Money Bank

Client deposits increased by 16% year-on-year to CZK 406 billion. Loans to clients grew only slightly by 0.3% year-on-year to CZK 267 billion. Moneta continued to report for 1Q capital adequacy 19.6% and liquidity coverage indicator reached a value of 360%.

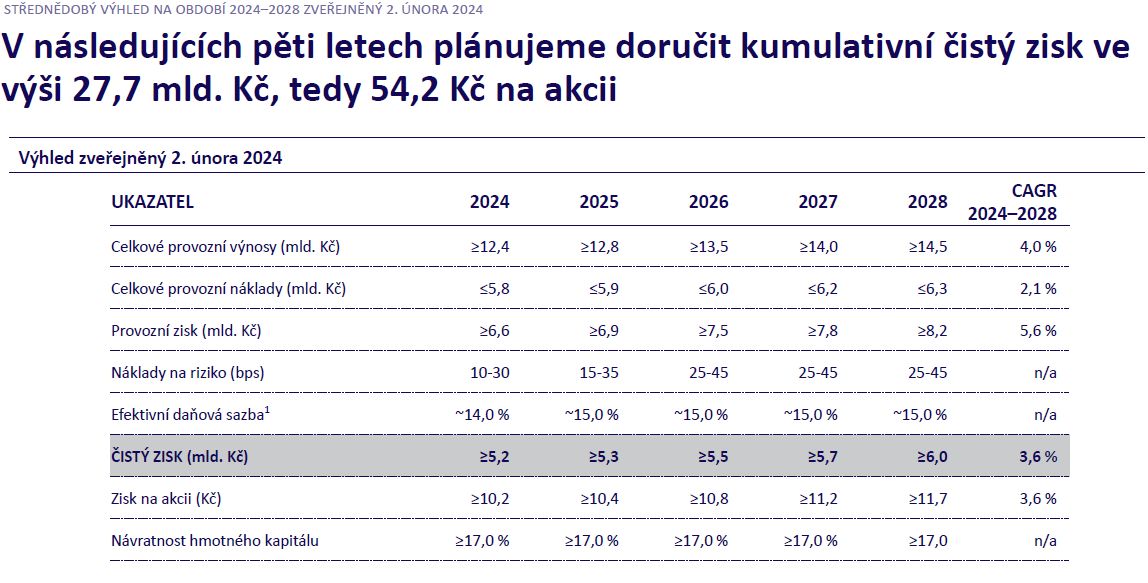

Management also confirmed theirs along with the results medium term outlookwhich he already presented with the results for 4Q 2023. He continues to aim for a net profit of at least CZK 5.2 billion (CZK 10.2 per share) this year.

Moneta Money Bank medium-term outlook, source: Moneta Money Bank

We evaluate the results as slightly positive and do not have a material impact on ours target price of CZK 104 per share.

Before the results, Moneta shares (BAAGECBA) closed at CZK 103 on the Prague Stock Exchange and at CZK 103.4 on the RM-SYSTEM.

Source: Moneta Money Bank

Karel Nedvěd, Fio banka, as

Tags: Moneta Money Bank presented results track deliver fullyear target

-