European stock markets rose slightly for most of the day, but later in the afternoon began to lose ground and slip slightly into the red. Investors focused on corporate earnings reports and comments from central banks. In the second half of the day, the comments of the head of the UBS bank had a negative impact, who, in response to proposals for a new strengthening of capital requirements, noted that the bank is definitely not “too big to fail”. His comments contributed to the decline of the bank index in the final by about 1.5%.

The technology sector is improving by more than 2% today after Tesla’s results yesterday. Although its results were not good, Musk promised to speed up the introduction of new, more affordable models, and this was greatly appreciated by the market. The sector was also supported by strong results from Dutch semiconductor manufacturer ASM International.

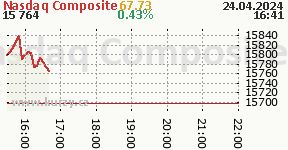

US stock markets start the day slightly in the plus with support in technology. The markets are in tense anticipation of the results of the technological leaders. Today it’s IBM and Meta’s turn, tomorrow Alphabet, Intel and Microsoft. Also a few “traditional” companies like Ford, General Dynamic, Boeing and tomorrow Merck, Caterpillar Northorp Grumman and others. Roughly a third of the main SP 500 index should present results this week.

The US dollar is strengthening slightly against the euro today.

The crown failed to sustain the morning gains and weakened in both major pairs for most of the day.

Oil remained mostly within touching distance of the $88 per barrel mark today.

Gold lost slightly against the stronger dollar, hovering near $2,320 an ounce.

BCPP today, especially in the first half of the day, was positively influenced by the interest in Erste and Moneta shares and the selling sentiment on ČEZ. Interest in the first-named pair waned as the day progressed. KB shares are slightly in the red in anticipation of VH results with increased liquidity.

The market is apparently taking the information about the STAN movement’s proposals for the possible introduction of a sectoral tax for the banking sector in stride. Likewise, the activities of CEZ’s minority shareholders in relation to the state’s extraordinary tax regulation.

Prague Stock ExchangeConclusion 4/24/2024 | ||||

| Name | Course | Change | Volume | Yesterday |

| COLT(CZG) | 630.00 | 0.32% | 2.80 million | 628.00 |

| ČEZ | 847.00 | -0.94% | 95.74 million | 855.00 |

| ERSTE | 1119.00 | 0.36% | 130.80 million | 1115.00 |

| GEN(NORTON) | 510.00 | 3.24% | 0.08 million | 494.00 |

| GEVORKYAN | 252.00 | -2.33% | 0.35 million | 258.00 |

| KB | 869.50 | -0.29% | 204.48 million | 872.00 |

| KOFOLA | 275.00 | 0.73% | 0.48 million | 273.00 |

| COIN | 103.00 | 0.00% | 44.66 million | 103.00 |

| PHOTON | 44.65 | -2.08% | 0.20 million | 45.60 |

| PILL | 181.00 | -4.74% | 0.37 million | 190.00 |

| P.M | 15840.00 | 0.00% | 5.50 million | 15840.00 |

| PRIMOCO | 890.00 | 0.00% | 0.20 million | 890.00 |

| VIG | 750.00 | 0.67% | 2.76 million | 745.00 |

| More: Stock market conclusion | 488.42 million | |||

Main news and comments on daily market events:

12h – Europe continues to grow, BCPP adds thanks to Erste and Moneta, dollar strengthens, oil and gold weaken slightly

Tags: Summary Europe maintain mornings positive tuning markets results technology leaders BCPP red koruna weaker oil USD gold USD

-