Today, the European stock markets weakened against rivals, and this trend deepened towards the end of the day due to weak developments in the country. Investors continued to evaluate the flurry of company results first, and then in the afternoon the US macros, which were uncharacteristically unremarkable.

The industrial sector suffered the most, with the index falling by about 2%. On the other hand, there was a slight increase of 0.2% in the health sector. The sector is growing by

1.4% due to the influence of the announcement of the Anglo American takeover bid by BHP.

Today, the results represent, for example, Nestle, Deutsche Bank, Barclays or Airbus.

The American GDP in the 1Q of the year did grow, but rather significantly slower compared to estimates, and moreover accompanied by the growth of the key inflation indicator PCE, which the Fed prefers for assessing the development of inflation. Investors could also be wary of the negative impact of renewed inflation on the dynamics of the economy. US bonds increased their yields after the data, which is so negative for stock markets.

The consequences of Meta have had a significant negative impact on the technology sector. Investors are worried if the company has not yet pulled away from the net in its data payments, which was reflected in the drop of the company’s stock in the public post-trade phase by a whole 19%, which erased the full 200 billion USD from the company’s capitalization. In the daily premarket, the company lost another 13%.

8% loss today after all IBM shares.

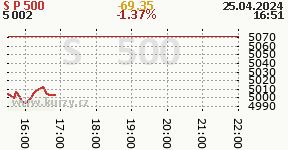

The US stock markets weakened significantly in the course of their morning trading session and had their worst trading day of the year. The doubt is described in detail.

The euro is slightly strengthening against the dollar for the first half of the day. The exception was the short seconds surrounding the announcement of US GDP and PCE development statistics. Presented gives the main world money for how far they have faltered.

Today, the koruna is stronger against the euro and the dollar.

Oil is weakening today, gold is going in the opposite direction.

Today, BCPP is affected by the fifth weakening action of KB and Erste. hundred of free funds went to EZ and Moneta, which had its last trading day today with a claim to a solid dividend from the good profit. KB shares corrected to 82.66 K per share after the tdr dividend was approved.

Prague Stock ExchangeClosing date 4/25/2024 | ||||

| Don’t call | Course | Change | Volume | Faith |

| COLT(CZG) | 634.00 | 0.63% | 5.37 million | 630.00 |

| EZ | 849.00 | 0.24% | 103.47 million | 847.00 |

| ERSTE | 1113.50 | -0.49% | 162.40 million | 1119.00 |

| GEN(NORTON) | 507.00 | -0.59% | 0.01 million | 510.00 |

| GEVORKYAN | 254.00 | 0.79% | 0.03 million | 252.00 |

| KB | 861.50 | -0.92% | 195.08 million | 869.50 |

| KOFOLA | 271.00 | -1.45% | 1.79 million | 275.00 |

| COIN | 103.40 | 0.39% | 60.38 million | 103.00 |

| PHOTON | 44.40 | -0.56% | 0.25 million | 44.65 |

| PILL | 181.50 | 0.28% | 0.68 million | 181.00 |

| P.M | 15800.00 | -0.25% | 6.21 million | 15840.00 |

| PRIMOCO | 885.00 | -0.56% | 1.51 million | 890.00 |

| VIG | 743.00 | -0.93% | 1.38 million | 750.00 |

| Subject: Stock Exchange | 538.56 million | |||

Mainly at first and comments to daily market day:

| R | Ketnskho EPCG reported a gross profit of EUR 7.3 billion for 2023. Of this, EPH alone EUR 3.6 billion The profit was K 4 billion. The esk dhry Group’s economy improved significantly year-on-year Moneta: Shares today with a dividend claim for the last time Currency: Profit over estimates will be generated from fees and their expense Komern banka: The general meeting approved a dividend of K 82.66 per share |

| as a result of 1Q24 | Barclays shares rise 4% after positive 1Q24 results AT&T: 1Q24 results change and outlook confirmed Deutsche Bank: sales slightly above estimates, confirmed by insight The meta winds up marrying AI. Investors, however, are concerned about whether the well spent money will be spent |

| energy | Czech households paid the most for electronics in the EU last year, even though Czechia also exported the most electronics to the EU |

| central bank | |

| macro | US – GDP grew by 1.6% in 1Q, the market grew by 2.4%. PCE grew by 3.4% = highest in a year Recent inflation developments and wage pressures in the euro area and the United States |

Tags: Summary macros collapse Meta send markets red BCPP weakened slightly koruna stronger oil weakens gold rises

-