In recent years, the effort to beat inflation has forced many inexperienced savers to think about the appreciation of money, but often in a very risky way. A lot of savings ended up in the unregulated realm, where it’s more likely that a high valuation offer means a greater risk of loss.

According to the estimates of the Association for the Capital Market (AKAT), which represents funds and companies subject to regulation, Czechs have at least one hundred billion crowns invested outside this sphere. Most often in corporate bonds, which have boomed in recent years.

According to her, the estimate of one hundred billion is two years old, so the current reality will probably be even higher. And this is due to the fact that high inflation was still catching up last year, but also due to the increasing dexterity of sellers and currently also due to falling interest rates on bank deposits, which can further strengthen the propensity to take risks among inexperienced savers.

“At a time of falling interest rates, people will look for an alternative, and if they get the wrong instruments at that moment, it’s something that will freeze us again for some time,” warned the head of Air Bank, Michal Strcula, at the conference.

“I think that the figure of one hundred billion is not far from the truth,” says Dušan Moskaliev, co-founder of Prime Fund, a company that manages larger investments for wealthier clients. Even there, missteps into loss-making or fraudulent investments are not an exception, as shown by the recent case of lost savings of well-known Czech athletes at JO Investment.

“With a simple sum of publicly available information from the press, we would add up at least 10 billion in embezzled funds, which are in the stage of judicial enforcement, insolvency, just in the last year alone. These are the stories of disappointed investors from the ranks of football and hockey celebrities,” says Moskaliev.

The boom in the unregulated investment sphere in recent years has a lot to do with the boom in corporate bonds, which are often protected by the consecration of the Czech National Bank, but in reality state supervision is in no way responsible for them. Prospectuses for issues over one million euros must be approved by the Czech National Bank. However, the CNB does not evaluate the business plan or financial health of the issuer in any way. The regulator only verifies whether the prospectus of the bond issue meets all the statutory requirements and thus provides investors with sufficient information for their own assessment and decision.

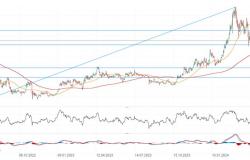

Last year, companies issued bonds in a volume exceeding 96 billion crowns. It was an increase of four percent year-on-year. In total, companies have already borrowed 634 billion over the past ten years through bonds. Along with the growth of the market, the number of issuers who went bankrupt is also increasing. There were 34 such cases last year, and investors lost a total of 5.4 billion crowns because of them.

Look at: The list The report compiled a ranking of the 100 most valuable Czech companies. By clicking on a row in the table or on the interactive graphic, it is possible to find out more details about the located company.